Although the Federal Reserve the US. These are not inflation-adjusted but people bid them to these levels as they fear losing their money if they.

If The Real Interest Rate And The Nominal Interest Rate Are Both Negative And Course Hero

Encourage consumption by discouraging saving.

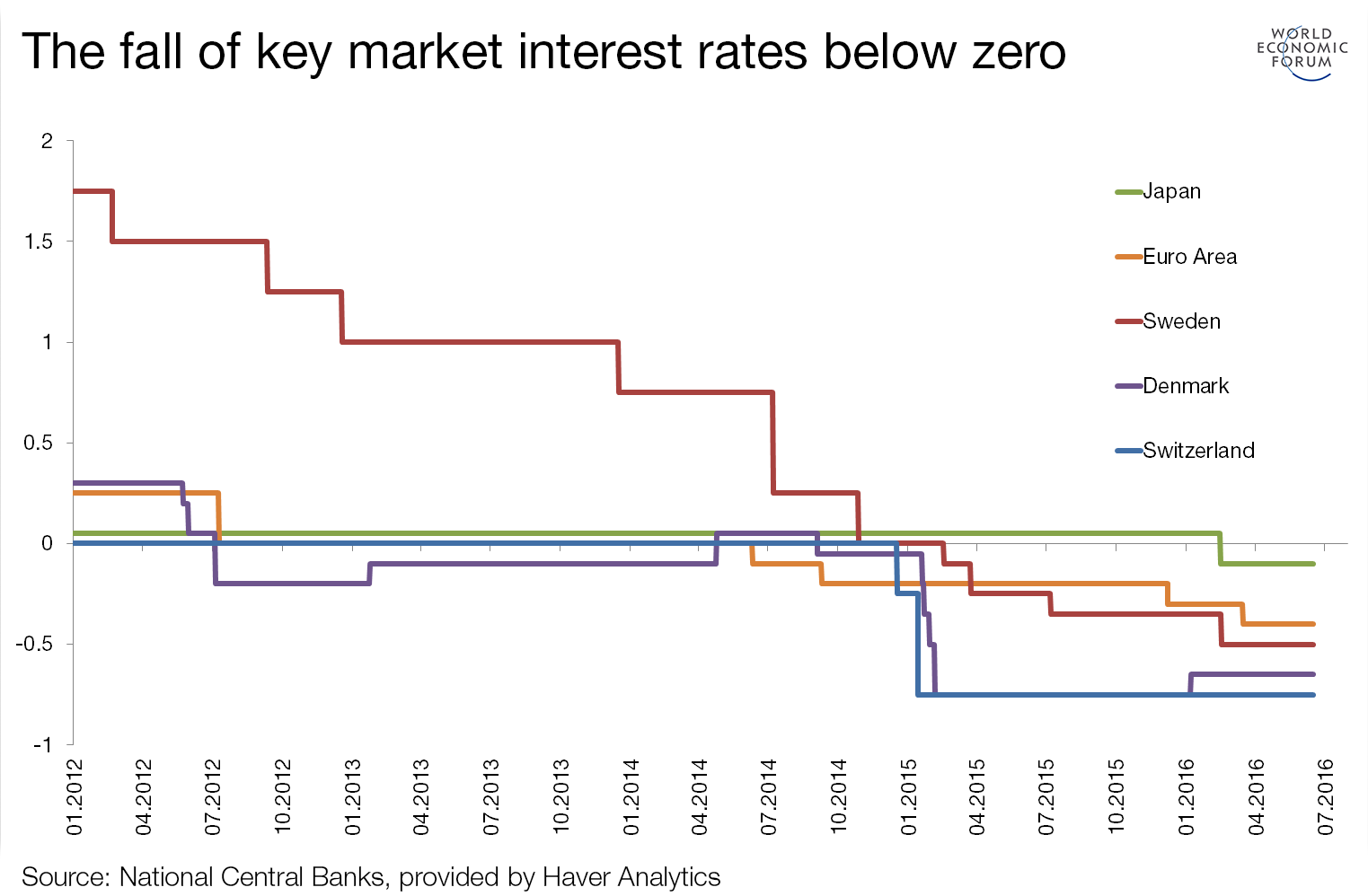

. This was not caused by nominally negative interest rates but rather by the fact that contractual nominal interest rates were lower than the rate of inflation. Answer 1 of 9. Yet as of mid-2016 the government bonds reflecting about one-third of global economy had negative nominal interest rates the Euro area Japan Sweden Denmark and Switzerland.

15 2020 when it cut the benchmark. It means in effect they are. If the real interest rate and the nominal interest rate are both negative and equal to each other then the inflation premium is zero.

So if an increase in inflation operates through conventional means so does a cut into negative territory of the full set of nominal government interest rates target rate interest on reserves lending rate between- tax-year rate postal savings rate and paper currency interest rate. Bcompete with private banks in the lending market. That is in interlocking clauses a central bank can put any bank with access to the cash window on the hook for i whatever paper currency interest rate the central.

The rental fee mechanism is equivalent to a central bank imposing a negative interest rate on a banks cash holdings beyond its cash holdings at the inception of the policy. Dencourage consumption by discouraging saving. Interest rates are now negative below zero for a growing number of borrowers mainly in the financial markets.

Cdiscourage consumption and encourage saving. Discourage the use of banks. Encourage consumption by discouraging saving.

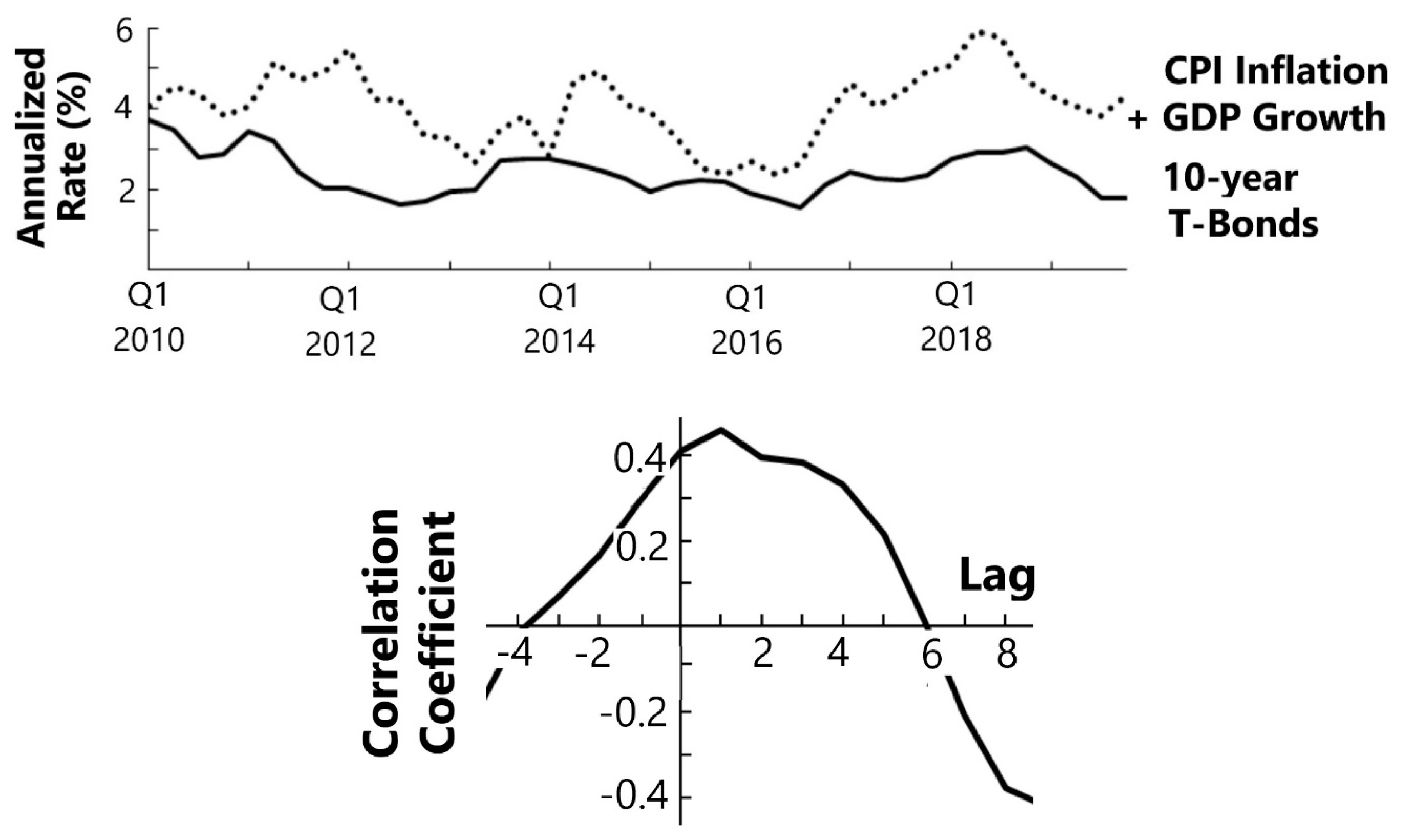

The second reason for adopting low-interest rates is much more practical and far. Bernanke 2012 argues that nominal interest rates are zero-bound essentially ruling out the possibility of negative nominal interest rates. Cdiscourage consumption and encourage saving.

Governments imposing negative nominal interest rates are attempting to discourage the use of banks. Central bank has never imposed negative interest rates it has come close with near-zero ratesmost recently on Mar. Discourage consumption and encourage saving.

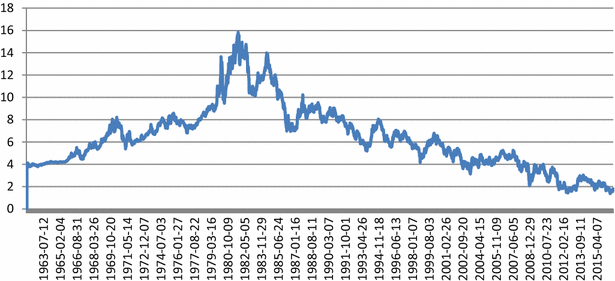

Certain short-term US Government bonds have sometimes traded with slightly negative yields. Negative interest rate policy NIRP is a last-ditch attempt to generate spending investment and modest inflation. For example setting a negative nominal policy ratea move that is by nature unconventionalmay surprise people and thereby send a strong signal of the central banks.

The reality is that nominal. Short-term German bonds are currently negative too. The International Monetary Fund IMF recently published an article on how to implement negative interest rates Officials want banks to be able to charge depositors for holding funds in checking or savings accounts.

The problem as they see it is that many depositors probably wont be willing to pay bankers for holding their money. Up to 10 cash back Bernanke 2012 argues that nominal interest rates are zero-bound essentially ruling out the possibility of negative nominal interest rates. Discourage consumption and encourage saving.

Level of total spending. QUESTION 13 Governments imposing negative nominal interest rates are attempting to discourage the use of banks. Yet as of mid-2016 the government bonds reflecting about one-third of global economy had negative nominal interest rates the Euro area Japan Sweden Denmark and Switzerland.

Encourage consumption by discouraging saving. Compete with private banks in the lending market. And the negative interest rate margin also became a huge burden on all state-owned banks.

Compete with private banks in the lending market. Dencourage consumption by discouraging saving. It is definitely possible.

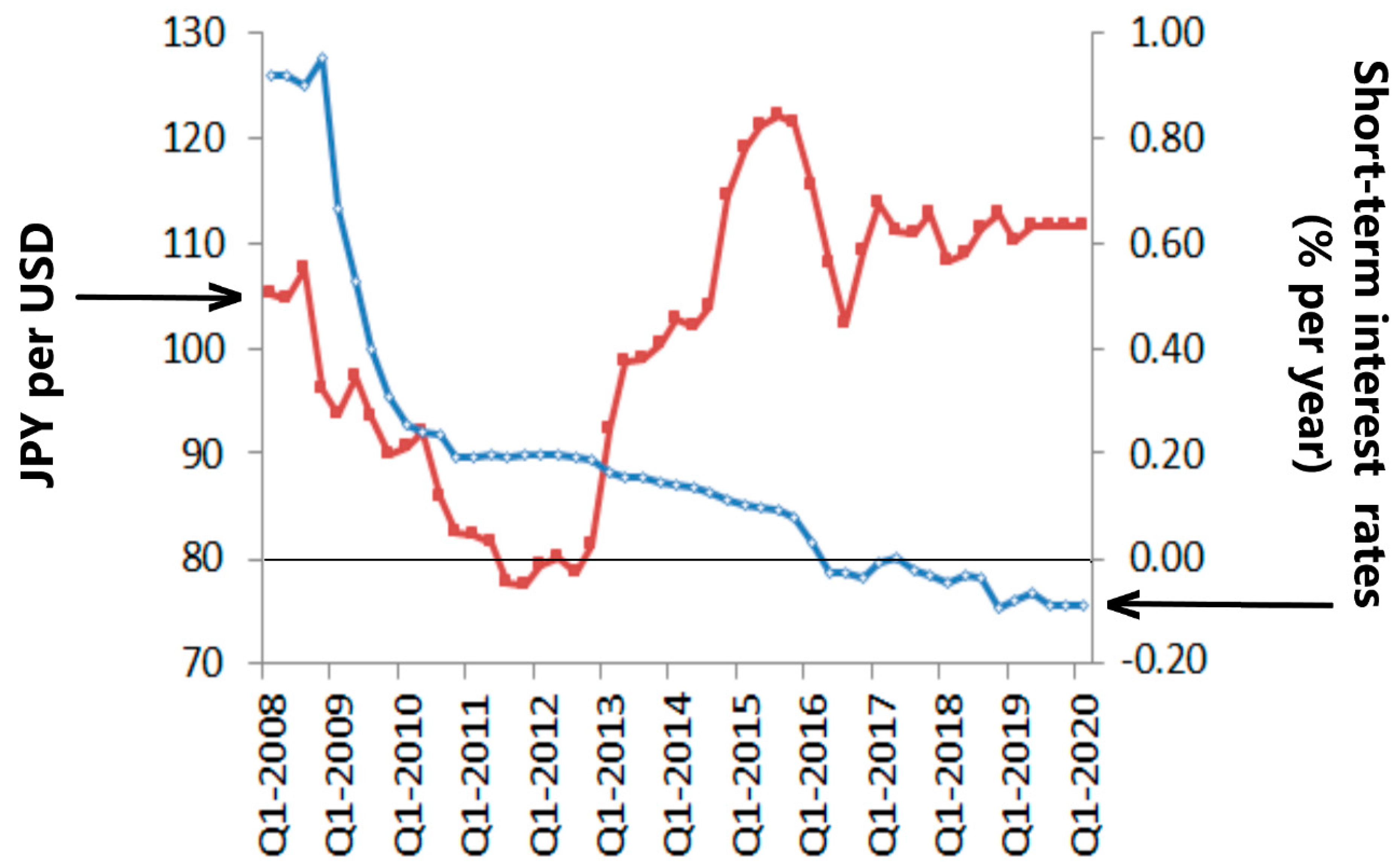

Governments imposing negative nominal interest rates are attempting to A. Since negative nominal rates and a higher inflation target both serve to reduce the lower negative bound on the real interest rate achievable by monetary policy they are to some extent substitutes. Thus the variation of the yen reflects other trends.

Governments imposing negative nominal interest rates are attempting to Adiscourage the use of banks. Thus it does not matter so much that the interest rate is negative. Observers often make the mistake of focusing only on real interest rates.

Governments imposing negative nominal interest rates are attempting to Adiscourage the use of banks. Discourage consumption and encourage saving. A low level of inflation is generally accompanied by lower interest rates causing the economy to grow faster and inflation to rise.

Put simply if your contract with the bank stipulated for instance a 2 annual rate on your deposit and the inflation rate reached 4 in that year youd have incurred a real loss. As pointed out by the economist Why investors buy bonds with negative yields some investors buy bonds to place bets on currencies. Several including the European Central Bank and the central banks of Denmark Japan Sweden and Switzerland have started experimenting with negative interest rates essentially making banks pay to park their excess cash at the central bank.

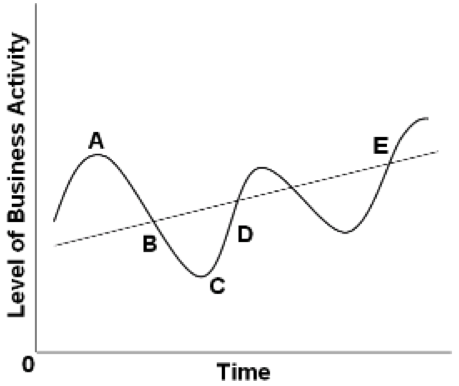

Governments imposing negative nominal interest rates are attempting to encourage consumption by discouraging saving Unemployment rates in the United States from 2005 to 2015 were in the range of 64 percent. In addition to this straightforward influence of negative nominal rates on real rates setting negative nominal rates may stimulate the economy in less predictable and clear ways. In times of high inflation the Federal Reserve has historically made interest rate increases to bring economic growth and bring inflation down in a low inflationary environment.

Negative interest rates are not incompatible with appreciation of the local currency. Compete with private banks in the lending market. Governments imposing negative nominal interest rates are attempting to encourage consumption by discouraging saving.

Negative Interest Rates Causes And Consequences Springerlink

Jrfm Free Full Text Negative Interest Rates Html

Jrfm Free Full Text Negative Interest Rates Html

Negative Interest Rates Absolutely Everything You Need To Know World Economic Forum

0 comments

Post a Comment